A Key Characteristic of Asset Measurement Is Best Described as

The reporting entity must control the future economic benefits. All of the answers provided.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

The reporting entity must control the future economic benefits.

. Represent current obligations of the entity. Fair value at the acquisition date. The key characteristics of an asset as defined in the Conceptual Framework include.

Disposal cost less depreciation c. The inspection process is a key tool and technique used in scope control. To record an asset a.

The best example to explain the concept of monetary asset is cash. It can be either separable or divided from the entity licensed rented or exchanged. Assets are the economic resources of a business that can be.

1 Future Economic Benefits. The key characteristic of an asset is that it represents a probable future economic benefit owned or controlled by an entity. Chapter 07 - Multiple choice quiz.

Purchased at a cost. Fair value at the acquisition date d. All of the given answers.

If the highest and best use of a. Assets are generally listed on the balance sheet. This means that the asset has capacity to provide services or benefits to the enterprises that use them.

A key characteristic of asset measurement is best described as. Future economic benefit or service potential is the essence of an asset. Such an asset stays unaffected by any macroeconomic event like inflation exchange rate fluctuations decreased purchasing power or demand-supply difference.

Key Characteristics of intangible assetsIAS38 are. The asset results from past transactions. There must be future economic benefits.

Using the information to manage earnings upward. This characteristic excludes financial assets such as receivables from being classified as intangibles 3. Fair value less depreciation.

Assets have the following main characteristics. Similarly in economics an asset is any form in which wealth can be held. Fair value less depreciation D.

An intangible asset must be identifiable to distinguish it from goodwill ie. Scope control is performed in. Because of its emphasis on markets is inserted to exclude many possible intangibles that are difficult to measure eg.

Assets are usually listed on the balance sheet. Average value based on all assets held by the company. The method used to account for oil and gas exploration costs that capitalizes the exploration costs of all unsuccessful exploratory wells is the full-cost approach A key characteristic of asset measurement is best described as.

There must be future economic benefits. The concept that distinguishes other intangible assets from goodwill is. Mean time to repair MTTR The mean time to repair represents the amount of time required to repair an asset.

The condition and location of the asset and any restrictions on the sale and use of the asset IFRS 1311. Probably the most accepted accounting definition of asset is the one used by the. The asset results from past transactions.

A foot describes what characteristic of measurement. A monetary asset is a tangible asset that has a fixed convertible dollar value. Staff morale good customer relations 2.

Disposal cost less depreciation C. 9 key performance indicators for asset management To measure the success of your asset management consider using these KPIs. Average value based on all assets held by the company b.

Scope control validates the delivered scope for the project. The two key characteristics of intangible assets are that they are identifiable and that they. Fair value at the acquisition date B.

The work performance measurements produced are part of the PMIS. An entity takes into account the characteristics of the asset or liability being measured that a market participant would take into account when pricing the asset or liability at measurement date eg. A key characteristic of asset measurement is best described as.

This KPI can be used to understand either the asset itself or the repair process. 18 the key characteristic of an asset is that it. View the full answer Previous question Next question.

Assets are usually controlled and managed by means of asset tracking tools. Measurement standardsgovernment regulation that guide the calculation of assets and liabilities. It has a normal balance or usual balance of debit ie asset account amounts appear on the left side of a ledger.

The key characteristics of an asset as defined in the Framework include. Non essential Characteristics of an Asset. Expert Answer 100 1 rating The key Characteristic of an Intangible Asset is that it will not have any physical form and has a legal form it is identifiable separately from the other assets.

For example assets may be measured by their historical cost or by their current replacement value and inventory may be calculated on a basis of last-in first-out LIFO or first-in first-out FIFO. Asset is not the same as ownership rather an asset is any form in which wealth can be held. Should have the power to obtain the future economic benefits flow to the entity.

The average exchange rate during the period Under IFRS when an asset is revalued upwards subsequent depreciation is based on the assets fair value All of the following are consistent with the purpose of determining the useful life of a long-lived asset except. Intangible assets must be controlled by the entity ie. Fair value at the acquisition date.

Managing Data As An Asset The Cpa Journal

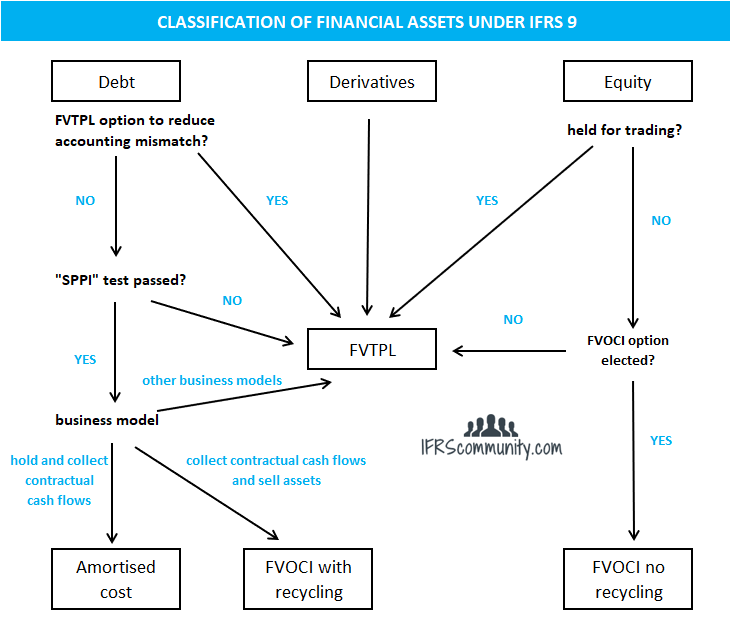

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed Bdo Australia

Classification Of Financial Assets Liabilities Ifrs 9 Ifrscommunity Com

Comments

Post a Comment